"As an organisation with community at its heart, ESG plays an important part in our investment strategy."

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

ESG Investing is on the rise! One of the few good things to come out of the last year is the increase in social awareness and the impact it’s had on companies and their drive to do ‘better’. Millennial Investors have really brought ESG investing into the limelight; but for those of you who still aren’t entirely sure what ESG stands for, I thought it timely to provide an overview and explain some of the key terms you may come across.

ESG or Environmental, Social and Governance are at their most basic, a set of criteria Investors use when deciding which companies and / or funds they invest their money in.

Environmental

Environmental

Possibly the easiest of the three pillars to understand and with the current focus on Climate Change, the area many Investors tend to focus upon.

Companies that adopt environmentally sustainable practices in the workplace or promote green or renewable energy would fall into this category.

Social

A much trickier area to define, Social looks at how companies treat people, both staff and those in the wider community.

Companies that pay particular attention to employee welfare, reinvest a proportion of profits into the community or have an ongoing commitment to corporate social responsibility would be seen as meeting this principle.

Governance

Governance

Governance looks at the way in which a company is managed from the top down and the way it polices itself.

It goes beyond legal frameworks and financial transparency to include how board members conduct themselves in terms of shareholder voting, conflict of interests and a commitment to corporate accountability.

Key terms

There so many key terms and phrases to be aware of when looking at ESG Investing, we’ve listed just a few of them!

Active ownership – actively using your rights and powers as a shareholder, primarily through voting, to influence the activities of a company.

B Corps - originally known as Benefit Corporations, B Corps are businesses which place as much (if not more) importance on social and environmental considerations as they do on shareholder profit. B Corps use their power to drive positive change for their employees, wider communities, and the environment.

Best in Class - Investment opportunities which can demonstrate they lead the way in their given industry or sector in terms of meeting and exceeding ESG criteria.

Corporate social responsibility (CSR) - a company’s commitment to operate responsibly and manage its impact on the environment and society in an ethical and sustainable manner.

Environment bill – the bill aims to improve air and water quality, protect wildlife, increase recycling and reduce plastic waste. This bill would be part of a new legal framework for environmental protection now the UK no longer comes under EU law.

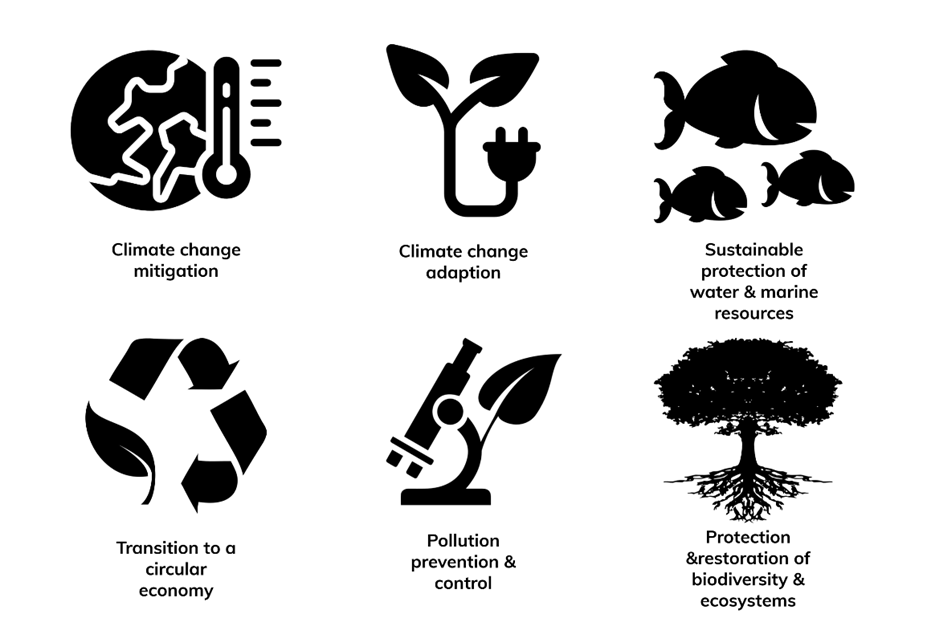

EU Taxonomy - a regulatory benchmark to “help Investors, companies, issuers and project promoters navigate the transition to a low-carbon, resilient and resource-efficient economy.” It defines ‘green activities’ using these criteria:

Greenwashing – not a new term by any means but one that has come back to the fore in recent years as more and more unscrupulous companies falsely portray themselves as ‘greener’ than they really are.

Impact Investing – specifically choosing investments with the aim of creating a positive impact on society or the environment whilst making a financial return.

Paris Agreement – the international treaty that aims to limit the global rise in temperature to below 2°C this century and ideally below 1.5°C.

Pension Schemes Bill – the bill will require large pension funds to disclose climate-related risks to assets in their portfolios by 2022, in line with the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations.

Principles for Responsible Investment (PRI) - a United Nations (UN) supported initiative encouraging Investors to use responsible investments based on 6 principles.

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

Socially responsible investment (SRI) – another term for ethical, responsible, sustainable or green investments.

Stewardship – the responsible allocation and management of capital to create long-term value for clients and stakeholders, leading to sustainable benefits for the economy, the environment and society.

UK Stewardship Code – First introduced in the UK in 2010, the Stewardship Code requires Institutional Investors to integrate ESG considerations into their decision-making processes. They must be able to demonstrate responsible allocation of funds with the goal of creating long term value for clients whilst creating sustainable benefits to the environment and society.

As an organisation with community at its heart, ESG plays an important part in our investment strategy. Every solution on our investment panel has been independently scored for ESG performance at a company and fund level. We take time to understand your feelings towards responsible investment and make recommendations that align with them.

Over the next few months, I’ll continue to delve further into the world of ESG investing and look at examples of companies that are paving the way and those who could do better!

By Daren Wallbank, Chartered Financial Planner