“Cash is like oxygen – you want to be sure it’s around, but you don’t need to have excessive amounts of it around” – Warren Buffet.

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

“Cash is like oxygen – you want to be sure it’s around, but you don’t need to have excessive amounts of it around” – Warren Buffet.

So how much cash should we hold?

- A couple holding cash ISAs may be missing out on £15,368 of real return over 10 years

- Inflation and opportunity cost are factors that impact real returns

- With inflation looking like being at its highest for years, the erosion of value is increased.

We are approaching ‘ISA season’ when financial advisers typically draw their clients’ attention (rightly) to the benefits of sheltering their hard earned income in an ISA. In a nutshell, you won’t pay any tax on the interest or growth you get from the money you have in an ISA, which is so attractive that there are limits to how much you can put in annually.

However, it’s also worth considering what the money in your ISA is actually in - is it in cash, or is it invested in stocks and shares?

What do we mean by ‘cash’?

‘Cash’ means different things to different people. Some think of cash as physical money – the folding (and rattling) stuff. Many think of cash as including what is in their current account. Others include any money in immediate or short-term access deposit accounts, or cash ISAs.

One useful way of defining cash is any money you have which is both:

- Immediately available to you

- Is not invested, so it doesn’t have any investment risk attached to it i.e. if stock markets go down it won’t affect the value.

What are the benefits of cash?

Cash is immediately available, so it’s great for handling unexpected events. Those might be negative - your boiler gives up, or your children need a sudden bailout. They could be positive opportunities - you suddenly find the car you’ve always wanted, or you get an unexpected chance to take your dream holiday.

Even people with substantial investments are usually advised to keep an amount of cash. Why? Simply because if you need cash short term – either for an unexpected event, or for general living expenses, you don’t want to be having to sell any investments at a time when the markets might be down, or borrow at potentially high rates of interest. That would ‘lock in’ the losses.

How much cash to hold?

The amount is often based upon how much people ‘feel’ safe having. A more considered way to establish the appropriate amount is to think firstly in terms of time rather than actual amount. Ask yourself – ‘if anything bad happened, such as I was made redundant, how long do I want to know that we could manage at our existing rate of expenditure before our savings are exhausted?’

What are the downsides of cash?

How is it that you can have too much cash? Because cash isn’t earning anything whilst it’s, well…cash. In fact, its losing money, and in two major ways.

Firstly, you are losing through inflation. Secondly you are losing through the opportunity cost. In other words, what you could have gained through a higher rate of investment return, compounded.

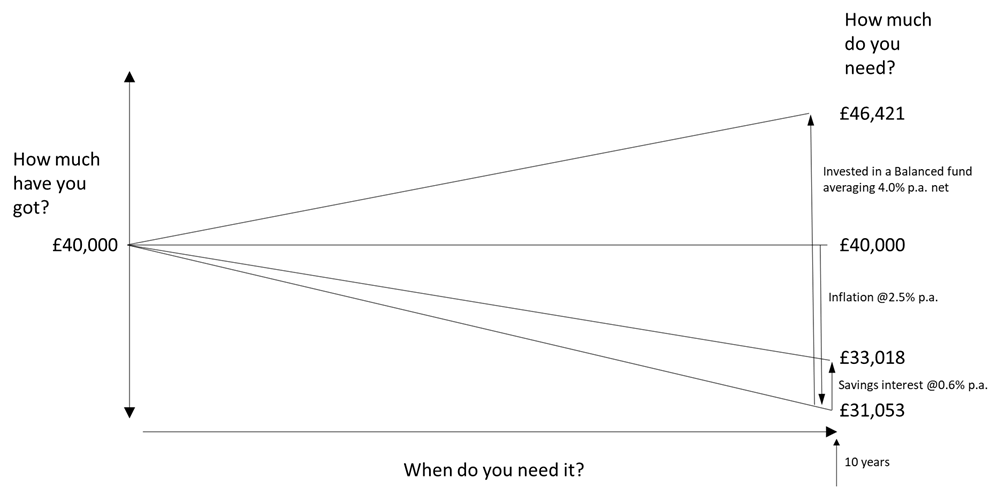

This diagram shows that, if you have £40,000 of savings in cash (for example, two cash ISAs of £20,000 each) earning no interest, then in 10 years you will have £40,000. Except you won’t, not really. Because its buying power in real terms will have been eroded. With inflation at 2.5% per annum1, it’ll only be worth £31,053 in today’s terms. You will have lost £8,947 of buying power.

Note:

Investors do not pay any personal tax on income or gains, but ISAs do pay unrecoverable tax on income from stocks and shares received by the ISA managers.

Tax treatment varies according to individual circumstances and is subject to change.

Stocks and Shares ISAs invest in Corporate Bonds; stocks and shares and other assets that fluctuate in value.

The value of investments and the income they produce can fall as well as rise. You may get back less than you invested.

But the losses from the opportunity cost are even worse. For example, a couple who invests these ISAs in cash rather than in a stocks and shares ISA with a typical balanced multi asset fund could lose out on an extra £15,368 in real terms i.e. accounting for inflation. Here’s how:

If you hold your cash in an instant access savings account you may get, say 0.6% p.a2. This means that you have still lost money, because the interest is less than inflation. So, after 10 years your £40,000 is now worth just £33,018. You’ve still lost £6,982 of buying power.

If you don’t need this £40,000 for 10 years, you may decide to invest it in a typical balanced fund, let’s say one with an average per annum gain of 4.0% (after fund charges). Now of course you can still get your money at any time by selling the fund – but you might not want too, because at any time the markets could be down and you could lose money if you decide to sell at that particular moment. So, let’s assume you won’t be touching the money for 10 years. Assume also that you pay no tax on the gain – either because it’s within your Capital Gains Tax allowance or is protected in an ISA.

In this case, you will have more than offset inflation, and will have £46,421 in the value of today’s money – a gain of real buying power of £6,421 after inflation. In actual terms you will have £59,210, which is the £40,000 compounded at 4% per annum over 10 years.

So, you will have avoided losing the difference between the invested amount and the savings amount - £13,403. You will have avoided losing even more if your alternative to investing had been to hold onto the cash in, say, a cash ISA or a current account that paid no interest – a loss of £15,368 avoided.

Of course, you’ll have your own numbers. But the principles still hold, so it might be worth asking yourself some key questions – “How much have I got?” “How much do I need?” And crucially to help avoid such losses – “When do I need it?”

By Daren Wallbank, Chartered Financial Planner

References

1.Bank of England Monetary Policy Report August 2021 p6 Chart 1.4

2. https://moneyfacts.co.uk/savings-accounts/easy-access-savings-accounts/