April 10, 2025

Weathering the storm: why long-term investments outlast market volatility (and even U.S presidencies)

Home / Weathering the stor...

Seasoned investors understand that wealth accumulation is a marathon, not a sprint.

With the economic turmoil we are currently seeing in the UK and across the rest of the globe, it’s important to keep a calm head and not panic. The scaremongers - sorry, news reporters thrive on daily headlines about stock dips, market crashes and economic uncertainty. However, successful investors know that patience is more than just a virtue, it’s a strategy.

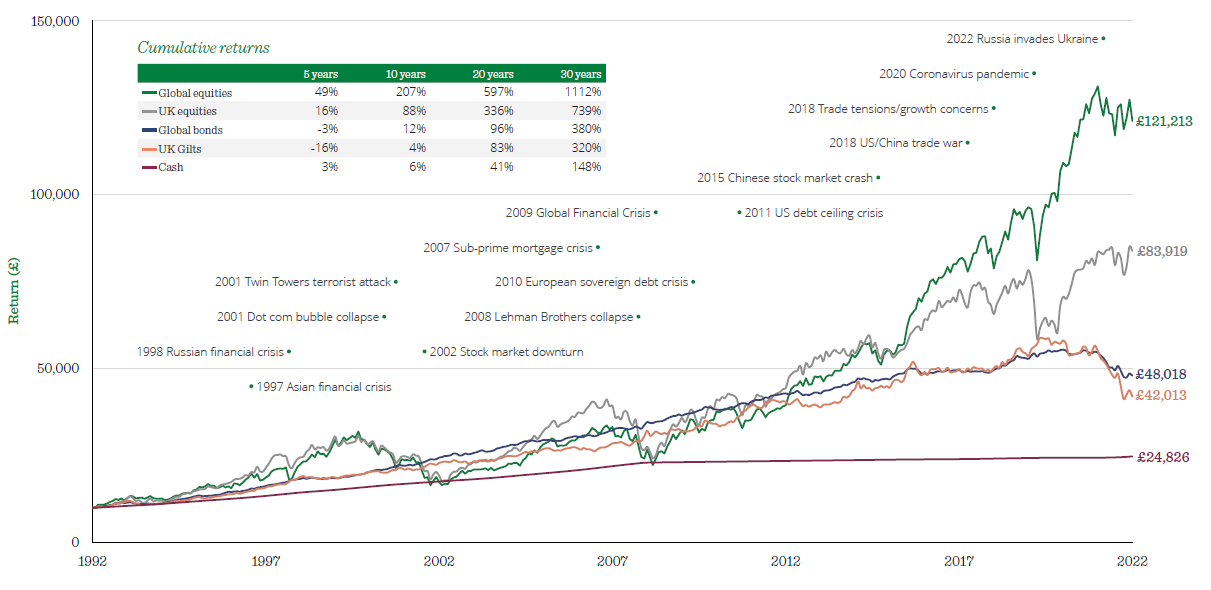

The importance of investing for the long term – taken from Quilter's "Investing in uncertain times"

The power of long-term investing

Markets are by their very nature volatile. External factors such as interest rate changes, geopolitical events, pandemics and economic policy shifts all cause sudden swings. But the reality is that markets have historically trended upward over time.

An investment into global equities could have grown to be worth more than 13 times its original value over the past 30 years¹ highlighting how long-term investors are often rewarded for their resilience.

Outlasting a U.S. Presidency

If we’re going to be completely honest much of the current market volatility can be attributed to the major political changes we’ve seen across the pond. And, whilst four years certainly seem like a long time at the moment, compared it to a twenty or even thirty year investment strategy, you begin to realise that thankfully these short-term ‘blips’ are temporary in the grand scheme of financial growth.

An investor tracking the S&P 500² through several presidential terms would see that market growth is attributed to multiple factors such as technological innovation, corporate performance, and global economic trends, rather than being driven by any one president.

The cost of short-termism

A knee jerk reaction to market downturns often leads to substantial losses. Cashing in your investment’s locks in the losses, whereas staying invested allows for potential recovery. Additionally, short-term trading often incurs higher fees, taxes, and of course there is an emotional toll of constant decision-making to consider.

Seasoned investors understand that wealth accumulation is a marathon, not a sprint. By focusing on long-term financial goals, you can harness the natural power of market growth and avoid the pitfalls of short-term uncertainty.

Key takeaway

While the world of finance is unpredictable, history has shown that patient investors tend to come out ahead. Just like a presidential term, market cycles come and go, but staying invested ensures your financial future benefits from long-term growth.

What next?

Speak to a financial adviser for expert advice. We can help to put your mind at ease about whether you’re doing the right thing. We can also help to take the emotion out of investing and provide an objective view. It may just be the best investment you ever make.

Read our guide for further information about investing in uncertain times

By Daren Wallbank

1Quilter – investing in uncertain times pdf - https://8565589.fs1.hubspotusercontent-na1.net/hubfs/8565589/investing-in-uncertain-times%20(2).pdf

2 https://www.investopedia.com/presidents-and-their-impact-on-the-stock-market-4587369#toc-how-presidents-impact-the-stock-market and https://www.macrotrends.net/2482/sp500-performance-by-president

Past performance is not a guide to future performance and may not be repeated. Investment involves risk. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited. 9/04/25.