Diversification is key to protecting your investments. We use a mix of different asset classes to help protect your portfolio from any sharp downturns in the stock market

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

What is a recession?

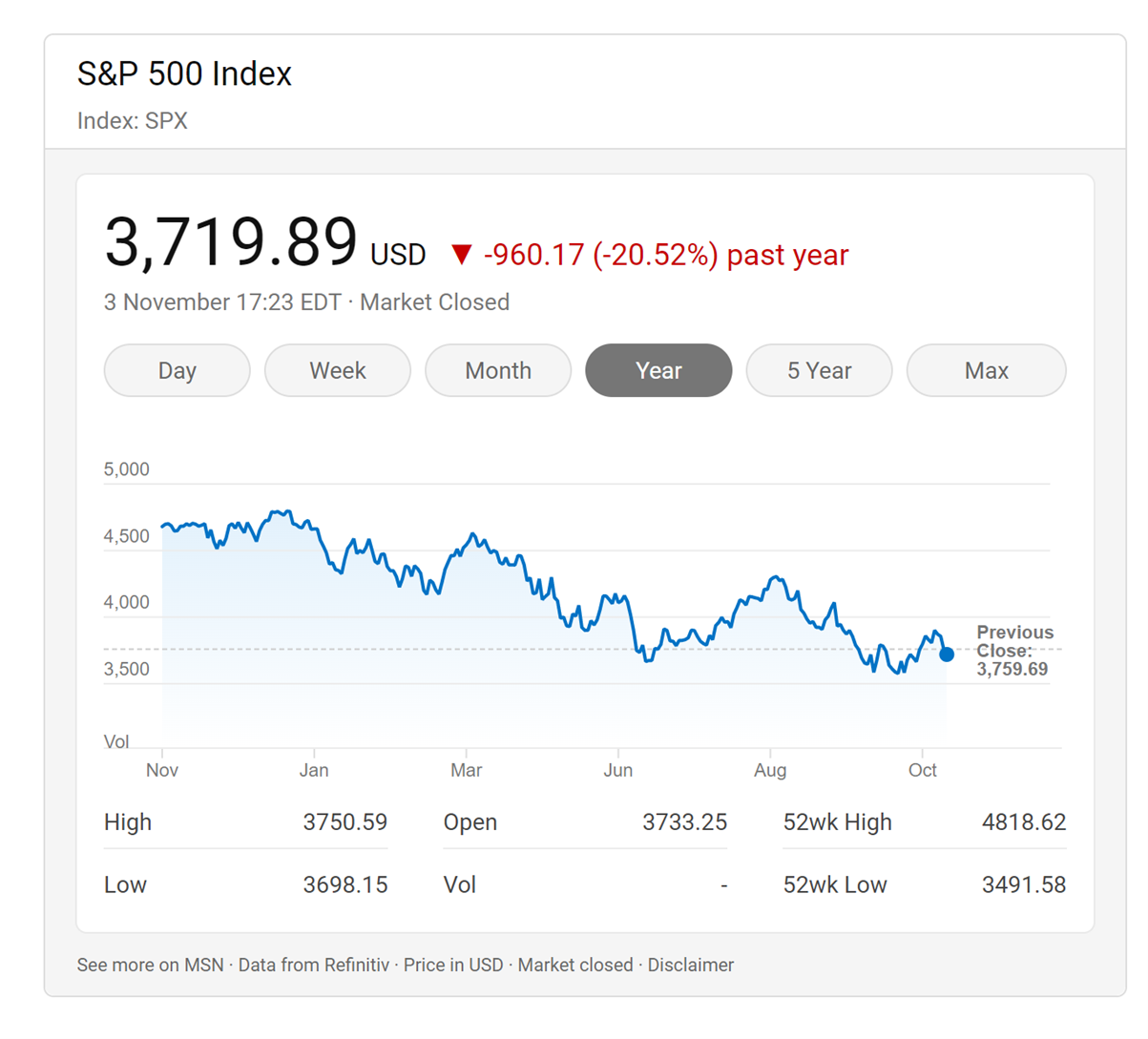

Very simply a recession is when the whole economy slows down. An ‘official’ recession begins when Gross Domestic Product (GDP) growth falls below 0% for two consecutive quarters. Generally accompanied by a bear market, which is defined as a 20% decline in the stock market. This has already happened in the US and is likely to hit the UK soon.

How does a recession affect World stock markets ?

In a recession people spend less often resulting in companies making less profit, which in turn results in a drop in share price. Stock markets are also heavily impacted by fear and many investors sell out of panic sending share prices even lower.

It’s important to remember that stock markets are essentially an auction and if someone is demanding to sell, buyers can take advantage and offer less. This means we generally see a drop in the stock market at the start of a recession but once the recession is underway the markets calm and historically start to rise well before the recession ends.

World stock markets are down. The world’s largest stock market the S&P 500, for example has already dropped over 20%. There may still be some short-term volatility but hopefully we should have seen the worst of it. In my professional opinion, the markets will bounce along the bottom for a while now, and once inflation drops, we should see the markets start to recover. Markets generally recover quite sharply once there is light at the end of tunnel.

How do we protect your investments from a recession?

Diversification is key to protecting your investments. We use a mix of different asset classes to help protect your portfolio from any sharp downturns in the stock market. Various asset classes perform better than others during a recession. For example, those classed as ‘essential stocks’ such as energy companies are likely to fare better than those that are reliant on discretionary spending, such as travel companies.

This system of portfolio diversification is further enhanced by our new model portfolio investment solution, Wealth Select. Where investments are regularly moved/ rebalanced between fund managers and assets classes automatically. This helps manage risk within your agreed risk rating to ensure the correct balance of risk and reward.

If you would like to find out more about our investment solutions please do get in touch with the team and we would be delighted to assist you.

What’s the impact of inflation on my investments?

On the whole discretionary consumer spending decreases as interest rates rise. This is supposed to reduce demand and so reduce inflation. Until this happens, inflation will continue to push up prices which can in some industries (where spending is more essential or consumers are less impacted by interest rates i.e., consumers without debt) lead to companies making higher profits. Even if the overall value of those profits is less in real terms than it was previously, the nominal profit increase generally leads to increased dividends and share values. This provides an element of inflation counter balancing. This may well mean that once inflation is back under control and the recession levels out company profits may not have dropped as much as they could have done if we had entered a recession without such high inflation.

There is no inflation linking with cash, which will take the full brunt of inflationary impacts, unless interest rates increase to a higher rate than inflation, which may happen later in a recession cycle, but even if it does, it is unlikely to be over a sustained period of time.

If you have any questions on any of the points raised, please get in touch with the Ginkgo advice team and we will give you detailed and individual advice to assist you in these volatile times.

By Daren Wallbank

The value of investments and the income they produce can fall as well as rise. You may get back less than you invested.