November 3, 2022

If the UK economy is struggling, does that mean my investments are too?

Home / If the UK economy i...

Given a large percentage of your investment is held outside the UK this approach means there is protection against the fluctuating value of the pound.

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

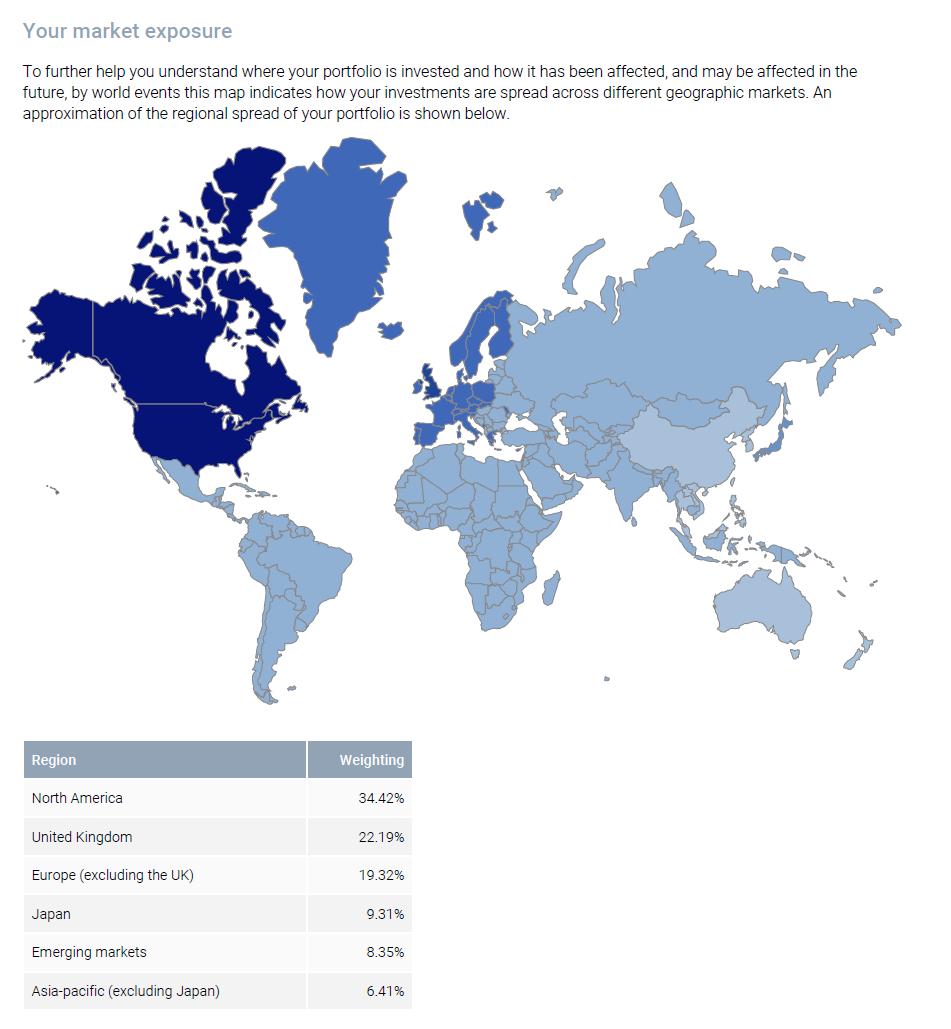

With the turmoil we are currently all seeing in the UK, many of my clients have asked me how this impacts their investments. And, whilst there is some impact, our investment portfolios are generally ‘global’, with only 15-30% invested in the UK.

The image shows a typical ‘global’ investment spread for a client portfolio. If you’re a Ginkgo client you will receive your personalised version at your next review meeting.

The image shows a typical ‘global’ investment spread for a client portfolio. If you’re a Ginkgo client you will receive your personalised version at your next review meeting.

Given a large percentage of your investment is held outside the UK this approach means there is protection against the fluctuating value of the pound.

As the largest market in the world, the USA tends to hold the largest share of your investment portfolio. Our investment portfolios have zero investment in Russia.

The USA took an early and aggressive approach to combating inflation and thankfully there are signs that inflation across the pond is now slowing. Whilst there were big market falls in the USA, we believe the worst is over and their markets should recover sooner than the UK and Europe.

A key thing to remember is that stocks and shares have a good degree of inflation protection. Businesses often increase their prices to cover inflationary costs so their profits generally increase in-line with inflation. I think it’s fair to say we have all seen these increases in our weekly shop.

The increase in prices usually means that whilst the actual profit number is larger, it is, in reality worth the same as before the inflation spike.

These increases to profit will take a while to feed through to increasing dividends and share prices, but it will happen.

Holding large amounts of sterling cash on the other hand has no such benefit. As interest rates are still only a fraction of the inflation rate, cash is losing ‘real’ value fast.

Whilst we have uncertainty around the UK entering a recession and ‘Austerity 2’, holding an emergency cash reserve (say 6 months expenditure) is recommended, holding cash for investment is not going to have a good medium-term outcome.

If you have any questions on any of the points raised, please get in touch with the Ginkgo advice team and we will give you detailed and individual advice to assist you in these volatile times.

By Daren Wallbank