April 27, 2023

7 times in your life when it makes sense to take financial advice

Home / 7 times in your lif...

Consider the increased benefit of an entire family taking a collaborative approach to their finances.

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

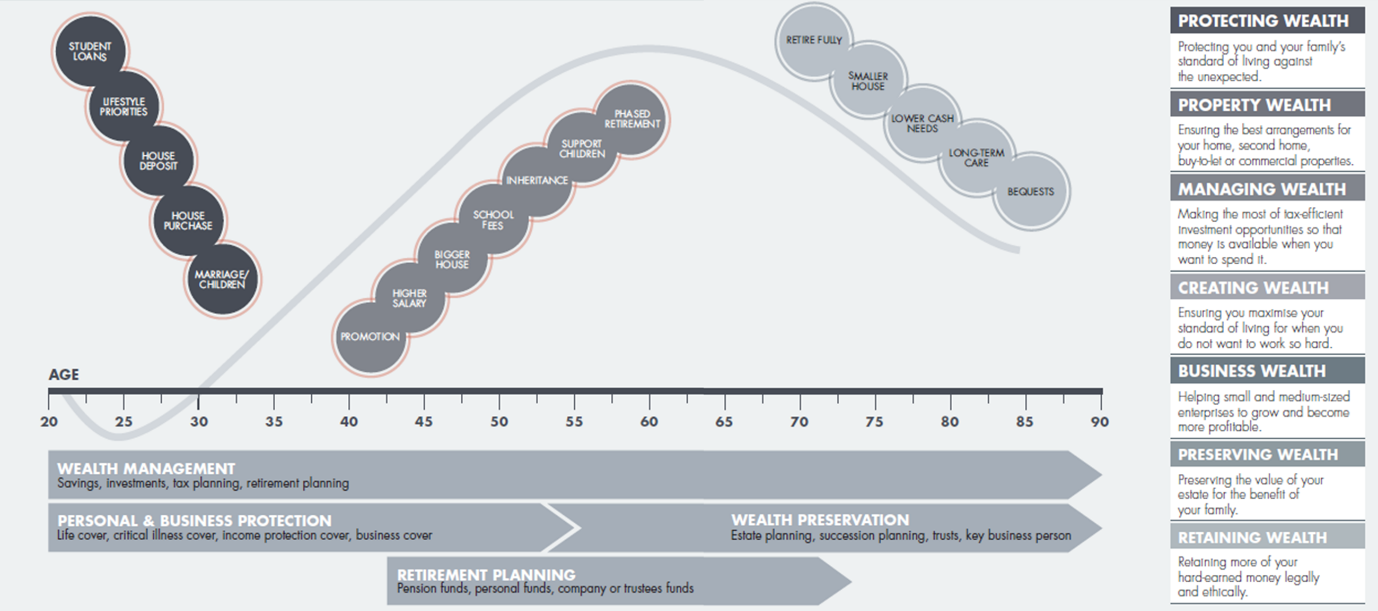

I am a strong advocate of taking regular financial advice – and the graphic below shows just how many stages there are in the average life where professional advice can add value. But I also understand that not everyone will have the time, resources or need to commit to on-going advice. If you’re one of these people, I’d say don’t discount advice altogether. There are at least seven stages in everyone’s life where it is crucial to seek financial advice.

At the start of your career – I don’t mean your first paper round (do they still exist?) but when you are in your first ‘serious’ role that provides a steady income. At this point, a financial adviser can help you set financial goals, create a budget, and plan for future. It’s also a great time to look at life insurance as the premiums will be lower due to your young age.

Before saying I do – Whether that be marriage, civil partnership or living together, it’s a big step! Talking about your finances both with your partner and your adviser is so important. An adviser will be able to explain the benefits of linking accounts and investments as well as reducing tax liabilities by making sure assets are held in the right name.

Starting a family - There’s no getting away from it, children are expensive! When you start a family, your household’s financial outgoings increase significantly. More often than not, at exactly the same time as your income decreases due to one of you staying at home (at least for a little while) to look after your new bundle of joy! A financial adviser can help you create a family budget, choose the right insurance policies, and plan for your children's future.

Mid-career - At this point in your life, you may well have spent more time focusing on climbing the corporate ladder than looking at your finances. This is a great time to check you’re still on track to meet your financial goals. A financial adviser can help you plan for your retirement, manage your debt, and invest your money wisely.

If you come into money – Whilst you’re unlikely to win the lottery, chances are you’ll inherit from a family member or get a windfall from some source at some point. And, while it might be tempting to spend the extra cash on a once in a lifetime holiday, a lump sum of money is great opportunity to plug any gaps in your finances or top up your pension. An adviser will be able to look at your financial situation, compare it your goals, and advise the most suitable way to use this extra money.

Approaching retirement – Hopefully, you will have had some form of financial review before this point in life and you’ll be on track for retiring as per your plan. Regardless, this is a great time to check if you need to postpone your retirement, look at part-time work or fully step away from the workforce. It is also a good time to look at tax mitigation, estate planning and will writing if you haven’t already!

In retirement - Just because you’ve stopped working, it doesn’t mean you money should too! A financial adviser can help you manage your retirement income, plan for unexpected expenses, and double check that your estate is properly planned.

These are the most critical stages in everyone’s life to take financial advice. But it’s worth mentioning that research shows that people who take advice regularly will be both financially and mentally better off than those whose don’t.*

So, whatever your current life stage, maybe now is the best time to call Ginkgo and see how we can help you make informed decisions about achieving your financial goals.

By Daren Wallbank, Chartered Financial Planner

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited. 25/04/2023

Tax Planning/Estate Planning & Will Writing are not regulated by the Financial Conduct Authority

* https://ilcuk.org.uk/peace-of-mind

https://ilcuk.org.uk/what-its-worth/

https://ilcuk.org.uk/the-value-of-financial-advice/